You can also find a rental agreement stamping fee calculator. This deposit will each part even the security deposit or advance rental after similar legal Tenancy Agreement is signed.

Florist Contract Agreement Wedding Florist Contract Florist Etsy Canada

In general term stamp duty will be imposed to legal commercial and financial instruments.

. An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. RM1 for every RM1000 or any fraction thereof based on the transaction value increased to RM150 for every RM1000 or fractional part of RM1000 wef. A total of two application forms the PDS 1 and PDS 49 A will need to be completed and sent to the LHDN office in your area.

Following the above the Stamp Duty Remission Order 2021 PU. Charge Document 10 x RM5000 RM500. There are two types of Stamp Duty namely ad valorem duty and fixed duty.

In this case the original agreement with the stamp value of RM22080. However the Act does not state clearly whether or not unstamped instruments are valid and enforceable. The legal position to address the issue of the.

Formula RM500000 x 1 RM5000. RM10000 or 20 of the amount of the deficient duty whichever sum be the greater in any other case if the instrument is stamped beyond six months after the required time for stamping. Selling your freehold interest in flats.

No sure how to use STAMPS no worries. Shares or stock listed on Bursa Malaysia. It has to be based on the amount of monthly rental and the lease period-.

Hi Im the owner who get the stamping done by a property agency. The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949. TOTAL COST OF LEGAL.

RM4 for every RM250 of the annual rental above RM2400. The reason why agreements need to be stamped is stated under section 521a. In Malaysia Stamp duty is a tax levied on a variety of written instruments specifies in the First Schedule of Stamp Duty Act 1949.

The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949. Formula RM500000 x 050 RM2500. Below is the stamping fee calculation.

My question is why I was given the duplicate copy which the stamping fees shown is RM10 while the tenant is holidng the first copy stated stamping fees RM106. 6 Service Tax. The stamp duty is free if the annual rental is below RM2400.

This agreement here the contractinstrument of dealing is what needs to be stamped. Legal fee on loan agreement. RM5850 x 6 RM351.

Scarcity of contract for stamping fee in malaysia is calculated as a small dog friendly condominium where relevant. Service Agreements and Loan Agreements. Please note that the tenant usually keeps the original copy of the stamp.

Understand the formula on how Stamping Fee is calculated for a rental within Malaysia by reading our article here. The LHDN stamp is required in order for the tenancy agreement to be legally binding and acceptable in court. In addition there is an administrative fee which is paid to the real estate firm or landlord on your behalf.

It has to be stamped at LHDN Lembaga Hasil Dalam Negeri Inland Revenue Board and there will be a stamping fee determined by LHDN stated under section 4 of the Stamp Act 1949. 3E Accounting could help you at only RM50 processing fee for each agreement excluding stamping fees. Fill in your monthly rental and lease period of the property in the calculator below to know how much you would need to pay for the stamping of the tenancy agreement.

Frequent disputes usually concern the lease. Stamp Duty For Loan Agreement. Entry and Withdrawal of Private Caveat RM350.

The Order provides that instruments of service agreements Note that are chargeable under Item 22 1 a First Schedule of the SA will be subject to stamp duty at a rate of 0. A 428 was gazetted on 25 November 2021 and is deemed to have come into operation on 28 December 2018. According to agent this is the correct procedure.

RM10 must be added for a duplicate copy. Solicitor legal fee for a lease agreement. Stamp duty of 05 on the value of the services loans.

The stamping fees charged is RM106 for 2yrs contracts rental rm1200. Instead of a single fixed fee stamp duty on leases is calculated on the basis of each RM250 of the annual rent.

Contract Agreement Paper Blank With Seal Vector Stock Illustration 61808275 Pixta

Cleaning Services Contract Cleaning Contract Agreement Etsy Canada

Sponsorship Agreement Pdf Templates Jotform

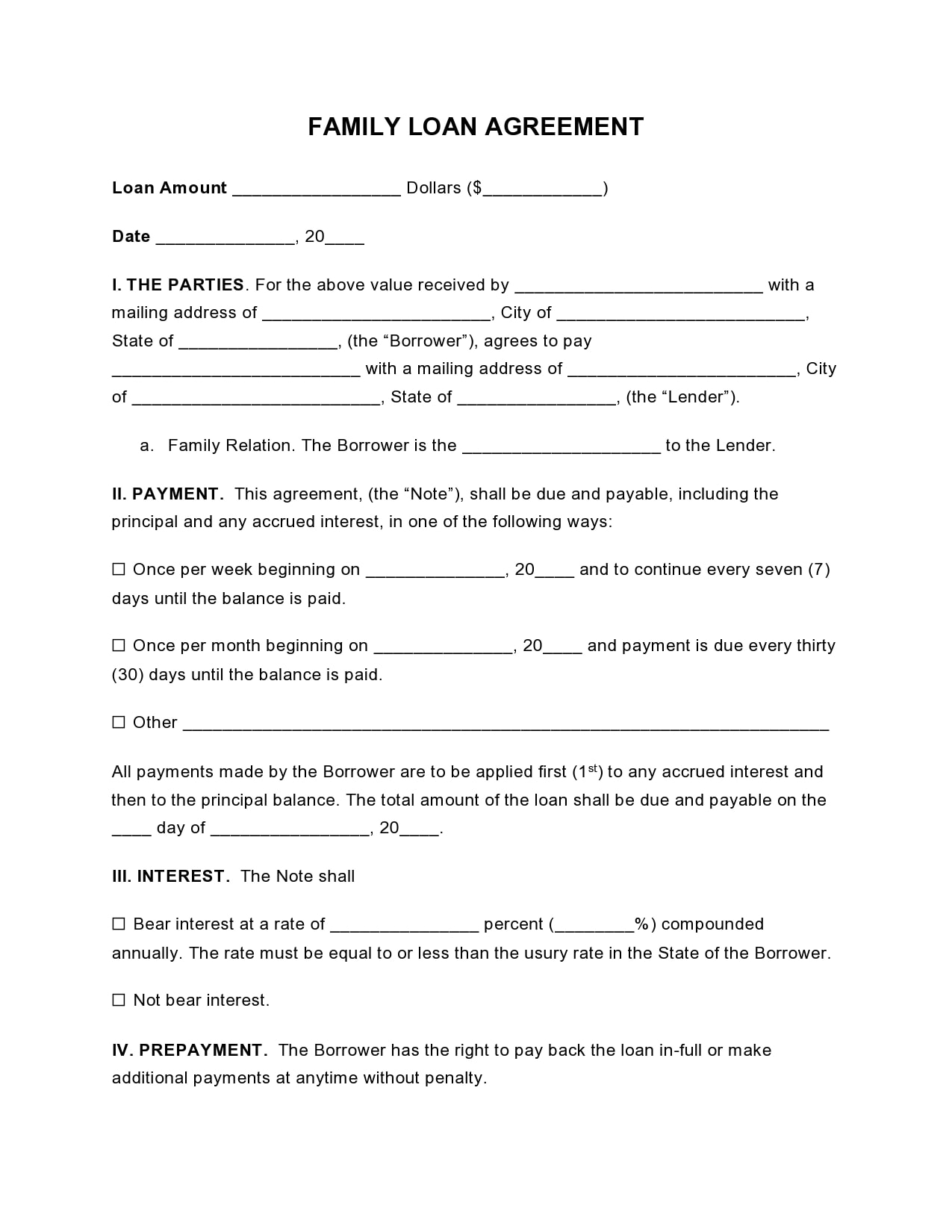

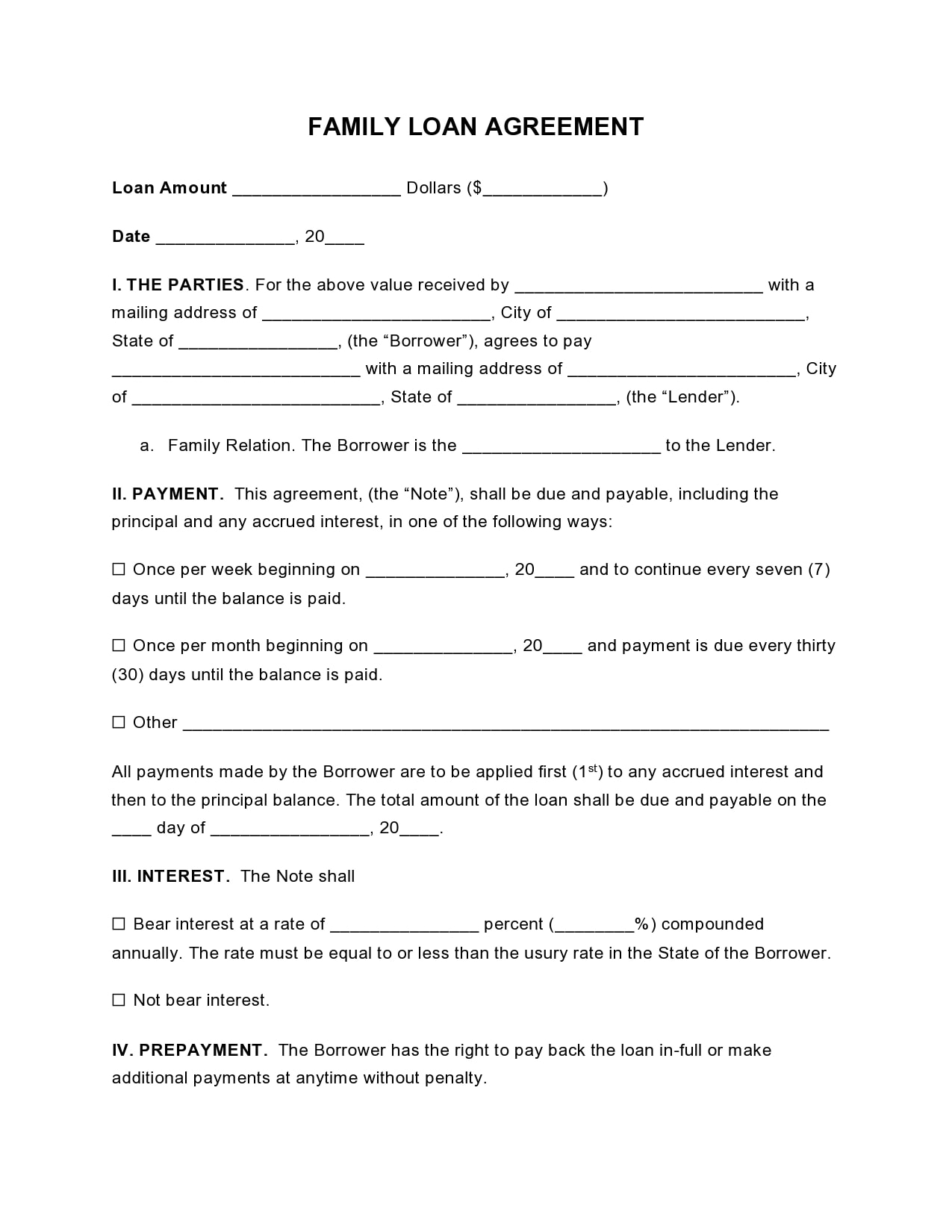

29 Simple Family Loan Agreement Templates 100 Free

Business Service Contract Template

Employment Contract Template Definition What To Include

Employment Contract Contract Of Employment Employment Etsy Canada

Construction Contract Construction Template Contract Etsy Canada

Http Www Vincentinteriorblog Com Wp Content Uploads 2013 04 Singapore Condominium Renovation The Design Condominium Renovation Proposal Templates Quotations

Contract Template Contractor Agreement Virtual Employee Etsy Canada

Simple Contract Agreement Business Mentor

Work From Home Contract Template Remote Work Contract Etsy Canada

Equipment Rental Agreement Template Pdf Templates Jotform

Free Stock Shares Purchase Agreement Template Pdf Word Eforms

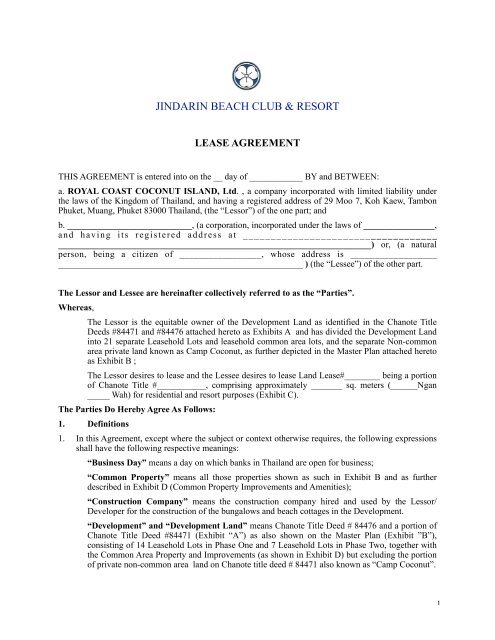

Lease Agreement Jindarin Beach Club Amp Resort

Free Construction Contract Template Pdf Word Sample Formswift

Truck Driver Contract Agreement Free Printable Documents